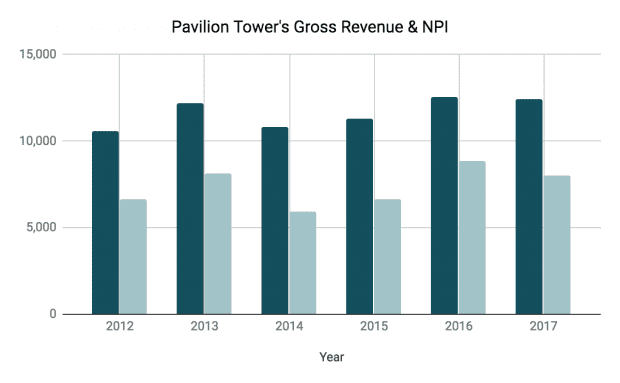

Yahoo Google Bursa Web TradingView. Pavilion REITs office property Pavilion Tower contributes only a very small portion of the REITs gross revenue.

12 Things To Know About Pavilion Reit Before You Invest

Thursday June 2 2022 About.

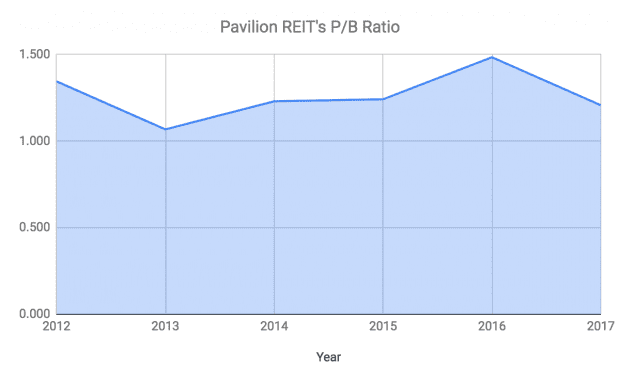

. Price-to-book ratio PAVREITs share price as at 23 August 2018 is RM163 and its net asset value per unit as at 31 December 2017 is RM130. I it is likely to be financed through debt and ii its strategic location. Real Estate Investment Trusts.

Maintain BUY with a raised MYR175 TP from MYR169 14 upside. The Company operates through. Pavilion REIT is the largest retail-focused REIT in Malaysia with a portfolio of retail properties valued at RM629 billion in total.

PAVILION REAL ESTATE INVESTMENT TRUST. Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Good Articles to Share.

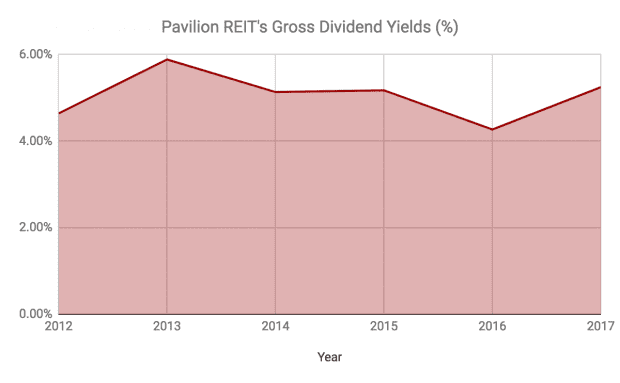

Pavilion REIT - 1QFY22 Above Our Expectation. The increase in margin was primarily driven by lower expenses. Get information about Pavilion REIT dividends and ex-dividend dates.

So the market may previously have expected a drop or else it expects the situation will improve. Investing Malaysia 16 January 2020. Trading Stocks - Pavilion Real Estate Investment Trust.

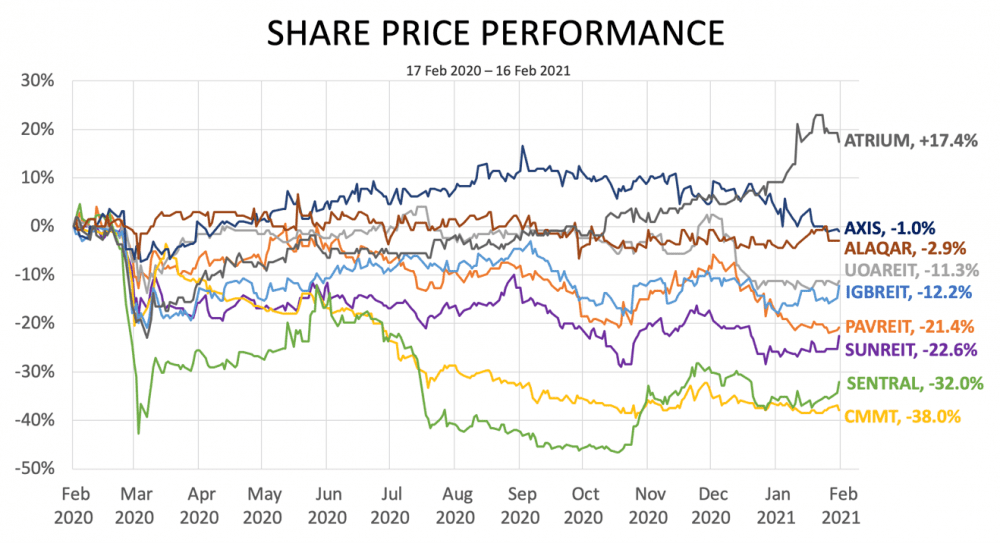

Pavilion REITs PREIT earnings are expected to pick up from 2H21 onwards as the country progresses with its inoculation programme We urge investors to look past the short-term earnings weakness in 2021 and to take a longer-term outlook on earnings Given the pull-back in share price and positive long-term earnings outlook. But the ve suggesting a rising price trend on volume and -ve suggesting a falling price trend on volume indicators should give readers a better idea of what the market is. The share price may move up or down from this point.

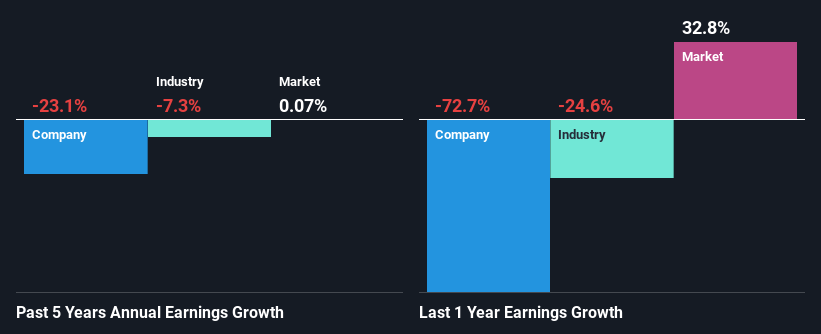

During the five years over which the share price declined Pavilion Real Estate Investment Trusts earnings per share EPS dropped by 32 each year. The variation to our forecast was due to stronger earnings recovery in 4Q20 In view of the weak share price we maintain our BUY call on PREIT especially. Thus its current price-to.

Rating as of Jun 2 2022. Hibiscus Briefing - 3rd Quarter Results for the period ended 31 March 2022. The Company is investing directly and indirectly in a diversified portfolio of income producing real estate used for retail purposes including mixed-use developments with a retail component in Malaysia and other countries within the Asia-Pacific region.

Pavilion Real Estate Investment Trust is a real estate investment trust REIT. My Watchlist Portfolio. Stock analysis for Pavilion Real Estate Investment Trust PREITBursa Malays including stock price stock chart company news key statistics fundamentals and company profile.

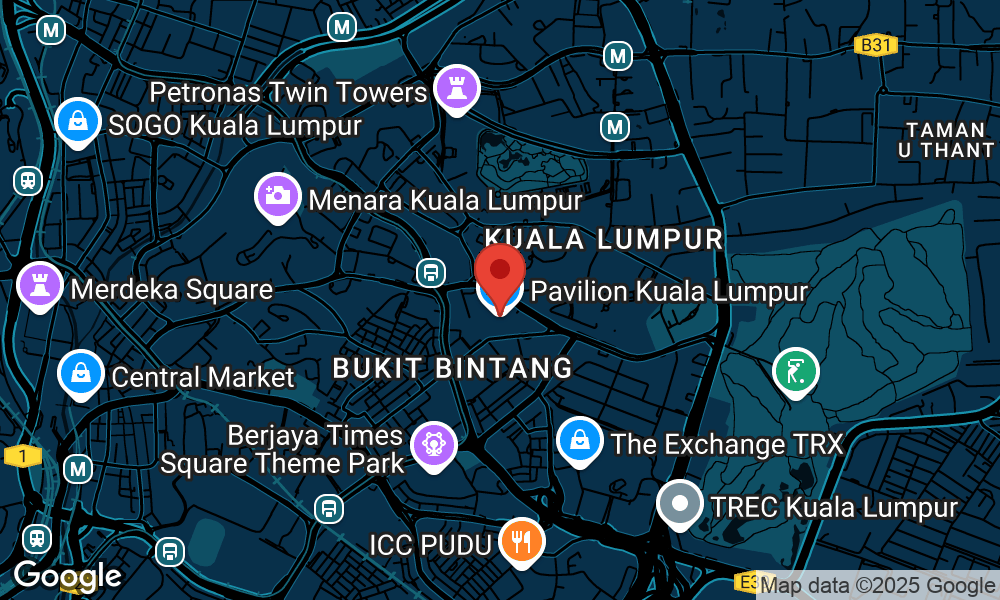

The principal investment policy of Pavilion REIT is to invest in income producing real estate used predominantly for retail purposes including mixed-use developments with a retail component in Malaysia and other countries within the Asia-Pacific region. Average investing volume for Pavilion Real Estate Investment Trust in the past three months in stock market was 7758k lots. Integrated Logistics Bhd up 15 sen at 525 sen.

Helpful 0 Unhelpful 0. 47 up from 25 in 1Q 2021. RM652m up 109 from 1Q 2021.

Pavilion Real Estate Investment Trust is a real estate investment trust REIT. The Company is investing directly and indirectly in a diversified portfolio of income producing real estate used for retail purposes including mixed-use developments with a retail component in Malaysia and other countries within the Asia-Pacific region. Get the latest Pavilion Real Estate Investment Trust 5212 real-time quote historical performance charts and other financial information to.

Pavilion REIT Says 1Q Net Property Income Up 60 Declares 221 Sen DPU. The principal investment policy of Pavilion REIT is to invest in income producing real estate used predominantly for retail purposes including mixed-use developments with a retail component in Malaysia and. Learn about Pavilion Real Estate Investment Trust 5212XKLS stock quote with Morningstars rating and analysis and stay up to date with the current news price valuation dividends and other.

Top Price Target. Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. As for now we can see huge pump breaking the previous bearish engulfing.

Quarterly Report - Q2 2020 30 June 2020 Quarterly Report - Q1 2020 31 March 2020Annual Report 2019. S-hldrs Int Section 138 of CA 2016. Pavilion REITs4Q20 realised net profit grew 25 qoq to RM40m from higher contributions across all assets except Intermark Overall FY20 results exceeded our expectations.

Price held at the 135 support zone for the past 2 months and wasnt able to breakthrough also potentially serving as the 2nd touch of a trendline. Pavilion REIT up three sen at RM135. Pavilion REIT OUT PERFORM 1QFY22 Above Our Expectation Price.

Revenue exceeded analyst estimates by 36. TTM Dividend Yield. PavREIT154 has announced the proposed injection of The Intermark retail asset for MYR160m.

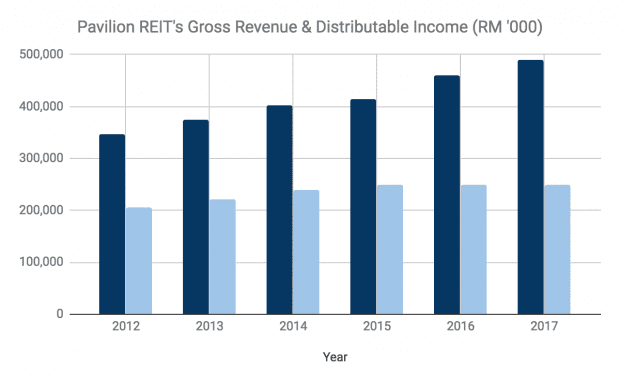

Pavilion Real Estate Investment Trust is a real estate investment trust REIT. Pavilion REIT derived 979 of its gross revenue in 2019 from its retail properties. The share price decline of 4 per year isnt as bad as the EPS decline.

Share Price Performance 110 115 120 125 130 135 140 145 YTD KLCI chg 19 YTD stock pr ice chg 40 Stock Inform ation. Here are 14 things to know about Pavilion REIT before you invest. Find the latest Pavilion Real Estate Investment Trust 5212KL stock quote history news and other vital information to help you with your stock trading and investing.

Earnings per share EPS also surpassed analyst estimates by 83. PAVREIT gets a score of 1712 in our equity and assets quality test based on current share price of RM175. Overall we can see that other REITs have showed upside movements as well.

30 Target Price. Mhyoung00 Mar 7 2021. PAVREIT Share Price Pavilion REIT is managed by Pavilion REIT Management Sdn Bhd which is responsible for the primary management activities related to Pavilion REIT.

Malton was having an indirect discussion today with Pavilion Reit in the matter of selling Pavilion Bukit Jalil to Pavilion Reit. Pavilion Real Estate Investment Trust - Stock Dividends. We are positive that the deal would be DPU-accretive as.

Over the next year revenue is forecast. You can find more details by going to one of the sections under. RM1388m up 100 from 1Q 2021.

Industrial Production Operation In July 2021

Pavreit Stock Fund Price And Chart Myx Pavreit Tradingview

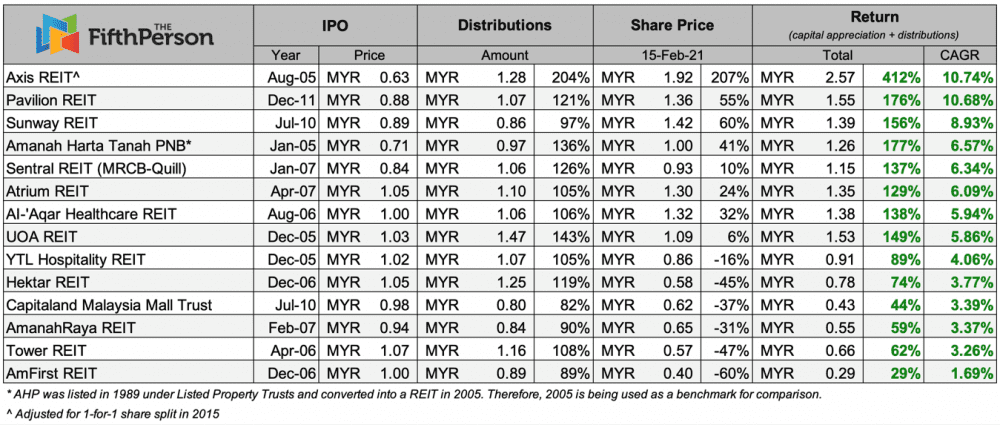

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Pavilion Real Estate Investment Trust Klse Pavreit Share Price News Analysis Simply Wall St

12 Things To Know About Pavilion Reit Before You Invest

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

Pavreit To Raise Rm370 6m To Fund Rm580m Pavilion Elite Buy The Edge Markets

Is Pavilion Real Estate Investment Trust S Klse Pavreit Recent Performancer Underpinned By Weak Financials Simply Wall St News

12 Things To Know About Pavilion Reit Before You Invest

12 Things To Know About Pavilion Reit Before You Invest

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

12 Things To Know About Pavilion Reit Before You Invest

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

Pavreit Share Price Pavilion Real Estate Investment Trust 5212

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

12 Things To Know About Pavilion Reit Before You Invest